Congressional calls for China to drop its policy of fixing the value of its currency, the yuan, to the US dollar have subsided since Republican House leader John Boehner said the US House of Representatives wouldn’t even consider a bill passed by the Senate in October 2011 to sanction China as a ‘currency manipulator.’ Trade and economic tensions haven’t subsided, however; they’ve shifted and are filtering down to the micro economic level, as illustrated by the filing of an ‘anti-dumping’lawsuit against Chinese solar photovoltaic (PV) manufacturers by CASM, an association of US-based solar PV manufacturers, with the US International Trade Commission (ITC) and Dept. of Commerce.

(Note: This is the same John Boehner (R-Va.) and House Republican Tea Party members that want to eviscerate environmental protections, stymie and snuff out clean energy policy and incentives, cut back on infrastructure, education and social spending, refuse to roll back tax rates on corporations on the super-rich to pre-crisis levels, refuse to remove huge, longstanding subsidies for heavy polluting industries and want to pay for extending payroll tax cuts by cutting back on Medicare payments and other social services. Wow. They’ve got my vote.)

An important aspect of trade, monetary and overall economic policy, foreign exchange rate policy is an issue that’s best dealt with by governments and economic policy makers, ultimately China’s, rather than at the industrial and commercial level. As with any contentious issue, prominent macro economists and economic policy think tanks have come out arguing both in support of and against China’s foreign exchange rate policy.

The ‘Jekyll and Hyde’ Nature of US Economic Policy

Proponents of pushing China to drop its US dollar peg, such as former MIT, now Princeton University economist Paul Krugman, assert that it’s a key factor in US, as well as global, trade and economic imbalances that continue to build, one that works to the detriment of trade and productive investment. Those who support China’s policy, such as Xu Hongcai of the China Center for International Economic Exchanges, point to the benefits the availability cheap Chinese goods have had for the US economy, as well as the benefits it’s had in terms of Chinese economic growth, development and social stability. They lay most, if not all, of the blame for current US economic ills on domestic conditions and policies, particularly the easy monetary policy, lack of regulatory oversight and lax lending standards of US banks for creating successive asset bubbles and subsequent busts.

Elements of the arguments’ on both sides have their validity. China’s policy of fixing the foreign exchange value of the yuan to the US dollar certainly isn’t the only cause of the US’ current economic ills, or even the primary one. Since at least the 1990s, the US Federal Reserve has employed a strongly asymmetric monetary policy that fuels credit expansion in times of economic growth, floods the banking system with liquidity and holds down interest rates at the first sign of an economic slowdown or potential contraction.

This ‘pro-cyclical’ policy in times of credit expansion adds to the ‘natural’ tendencies and instability of markets for financial assets and property, as opposed to goods. Congressional actions compounded expansionary monetary policy, breaking down longstanding protective barriers between commercial and investment banking while allowing banks to add leverage their capital bases to a much greater degree. At the same time, they significantly weakened financial industry regulations and oversight.

In contrast, monetary and fiscal policies have been ‘counter-cyclical’ when the first signs of economic contraction are perceived. Successive financial crises – which pro-cyclical policies played a big part in creating in the first place – have led to increasingly large ‘rescue’ packages and stimulative monetary and fiscal policy responses.

The Efficient Markets Fallacy

A growing number of economists contend that this coupling of monetary and fiscal policies and actions have played the leading role and shaped the course for the US economy in the past decade. Not only that, it’s ideologically inconsistent. While standing aside and letting credit expansions run their course is an orthodox ‘laissez faire’ approach, stepping in to prevent contractions and possible deflation is a distinctly ‘Keynesian’ approach.

The ideological quagmire and ‘Jekyll and Hyde’ condition macro economists and the nation find themselves in can be traced back to implicit acceptance of the Efficient Markets Hypothesis. Cxcept in times of economic contraction, that is, when it becomes clear in a painful, politically unacceptable way that the theory does not reflect economic reality. But this is a topic for another post, one I hope to examine at another time. Let’s return to China’s foreign exchange rate policy.

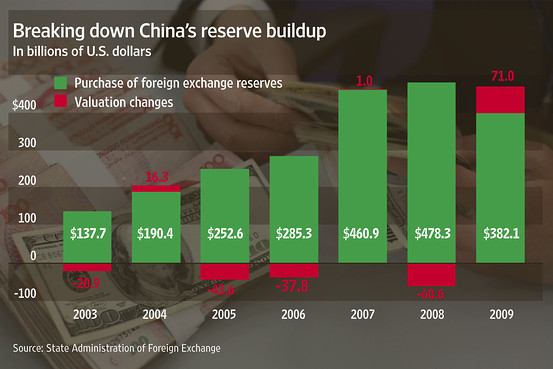

That domestic US policies have played a major role in the country’s economic ills doesn’t negate the vastly increased impact China’s US dollar peg has come to have on the US economy. Its foreign exchange and foreign investment policies have and continue to be long-term structural factors that not only distort and destabilize capital allocation, trade, money and investment flows within and between the US and China, but across all the world’s trading nations. The arguments China used in defense of the US dollar peg in the early part of the new millennium weren’t completely valid at that time. They’re not completely valid now, and in today’s circumstances, they’re increasingly politically unacceptable. I’ll examine them in the next part of this three-part series.