As the largest consumer and small business bank, BofA (NYSE: BAC) can have a major positive or negative impact on the environment. Since March, 2007, the bank has taken on a $20 billion initiative to “encourage environmentally friendly business activity” over the next decade. Applauded by some and criticized by others, just how green is this bank?

As the largest consumer and small business bank, BofA (NYSE: BAC) can have a major positive or negative impact on the environment. Since March, 2007, the bank has taken on a $20 billion initiative to “encourage environmentally friendly business activity” over the next decade. Applauded by some and criticized by others, just how green is this bank?

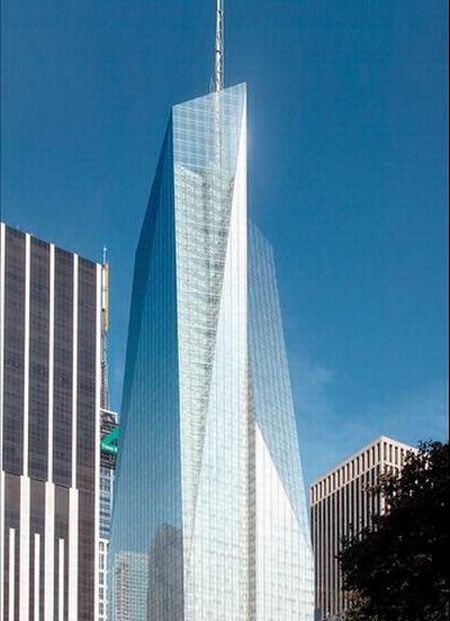

Crystalline Tower Office Building in Manhattan

BofA’s new 2.1 million square foot, 54 story tower is being heralded as the world’s greenest skyscraper. This $1 billion glass, steel, and aluminum skyscraper will use significantly less water and energy, while providing a healthy indoor environment.

It features a passive solar design, the use of recycled and renewable materials, and work stations with individual climate controls. Natural elements include the use of rain water and a green roof reduces energy use for heating and cooling. A graywater system will reuse waste water from sinks to flush toilets. A 4.6 megawatt cogeneration plant will generate heat and electricity.

First of all, it is the right thing to do for the planet,” said Senior Vice President, John Saclarides, when asked about the greening of the BofA tower. “No. 2 is the corporate responsibility. Bank of America is one of the leading corporations in the world, including profitability. We feel it is our responsibility to set an example for others to follow and show it can be done. This also causes the advancement of technologies used in green engineering.”

This building will have lower operating costs compared to most due to the reduced use of energy and water. The cogeneration plant for example has an estimated payback period of 10 years. The PR value of the building however is priceless, as it serves as a global example of an eco-friendly design.

Green Banking Centers

Of the $20 billion for green initiative, $1.4 billion is earmarked for achieving LEED (U.S. Green Building Council’s Leadership in Energy and Environmental Design) certification for all new office space and bank centers. Located in Adelanto, California, BofA recently opened one of the most eco-friendly banks in the nation.

The roof is lined with 64 photovoltaic solar panels that generate 60% of the bank’s electricity. 20% of the building is comprised of recycled materials. All the insulation for example is made from old blue jeans and counters are made of wheat byproducts. The bank will use 40% less water than most due to a drip irrigation system, low-water landscaping and water efficient plumbing fixtures.

Saving Trees

BofA decreased paper used for internal operations by 32% from 2000 to 2005, as the customer base grew by 24%. This initiative saved over a billion sheets of paper and undoubtedly save money. Their internal recycling program processes 30,000 tons of paper annually, saving roughly 200,000 trees every year.

Hybrid Vehicle Reimbursement

Hybrid Vehicle Reimbursement

185,000 U.S. employees are eligible for a reimbursement of $3,000 for the purchase of a hybrid vehicle. As of May, 2008, nearly 2,000 workers had taken advantage of this unique offer.

“This benefit began as a pilot in 2006 in L.A., Boston and Charlotte and was so well received internally that last year we expanded it to all associates company-wide,” says Senior Vice President of Media Relations Colleen Haggerty.

Credit Card Reduces Carbon Footprint

Partnering with Brighter Planet, BofA offers a Visa card that helps fund renewable energy projects. By spending $1000, one ton of carbon emissions are offset, which is the equivalent of taking a car off the road for 2,000 miles.

Funding Coal Creates Scrutiny

Funding Coal Creates Scrutiny

Despite all of these green initiatives, BofA has been boycotted by the Rainforest Action Network. The group states that BofA spent 100 times more money on highly polluting projects than on cleaner alternatives in 2006. BofA has been the top funder of mountain top removal mining and a lead financial backer of new coal-fired power plants.

Coal is the leading contributor to climate change and is responsible for nearly one third of the United State’s carbon emissions. It is also the leading cause of mercury contamination and a top contributor to asthma, air pollution, and wildlife habitat destruction.

Mountain top removal mining is a highly invasive practice that involves clear cutting forests, using dynamite to remove up to 1000 feet of mountain top, and dumping it in a nearby valley. This highly destructive practice has destroyed 1,200 miles of streams, flooded communities, and disrupted sources of drinking water. Reclamation efforts are extremely difficult and many mining sites are left looking like the surface of the moon. The Environmental Protection Agency estimates that 1 million acres in the Appalachian Mountains have been destroyed by this practice. BofA has relationships with all of the top five producers of coal extracted by this method.

Funding Coal-Fired Power Plants

Funding Coal-Fired Power Plants

Despite the dark side of coal, there are plans for 150 coal-fired power plants in the United States and BofA ranks as a leading lender for these projects. The bank was part of a lending syndicate that provided Duke Energy with $3.2 billion for constructing several new coal-fired power plants in Indiana and North Carolina. With a lifespan of 50 years, these coal plants can have a major impact on climate change and public health for decades.

“This new coal rush would add between 600 million and 1.1 billion tons of additional carbon dioxide emissions annually and negate nearly every other effort currently on the table to combat climate change,” states the Rainforest Action Network.

“Unlike the credit crisis, we can’t bail out a dead planet,” said Rebecca Tarbotton, director of RAN’s Global Finance Campaign. “Bank of America’s reckless investments in new coal-fired power plants are locking in an outdated energy infrastructure that threatens our climate, our communities, and our economy.”

The Carbon Principles however might change the way that many leading banks fund coal-fired power plants. The Principles establish guidelines for banks to consider the risk factors of loans to power companies and were adopted by BofA. The Principles take into consideration that the U.S. may eventually cap carbon emissions and that there may be a cost for them, thus factoring in future liabilities that may be incurred. Although the Principles certainly help protect banks and can be in their best financial interests, it also has environmental benefits. BofA did however fund Duke Energy in the same month that they signed the Carbon Principles, so it is unclear at this point the impact it will have on lending practices that involve coal.

Is BofA a Pale Green?

Do the BofA’s initiatives have enough teeth to green the bank or are they mostly just a greenwashing effort? Although they certainly excel in making their daily operations eco-friendly and by offering some innovative programs to employees and customers, does that outweigh their involvement with coal?

As one activist said, “Bank of America is watering the flowerpot while they help burn the whole house down.” This puts into perspective the scale and gravity of their practices that support coal.

Installed wind power grew by 45% and the solar market grew by 67% in 2007. There is no explanation for BofA to fund highly polluting projects 100 time more than cleaner alternatives during a time when cleaner alternative are so growing dramatically. Unfortunately, it might take a cap and trade system to change these practices, which could have a huge financial impact on a bank that is so heavily involved in the coal industry.

Not that it matters to some people, they give a ton of money to the Republican Party, as do many banks. Local credit unions are probably the most socially responsible way to go. Better World Guide agrees with me.

Not that it matters to some people, they give a ton of money to the Republican Party, as do many banks. Local credit unions are probably the most socially responsible way to go. Better World Guide agrees with me.

New Resource Bank is another good choice.

http://newresourcebank.com/

Great post, Sarah!

Co-op America did a related story on the greeness (or lack thereof) of credit card issuing banks, which is referenced here:

http://ecopreneurist.com/2008/08/13/more-on-creative-financing-for-green-businesses/

Thanks– Leah

Great post, Sarah!

Co-op America did a related story on the greeness (or lack thereof) of credit card issuing banks, which is referenced here:

http://ecopreneurist.com/2008/08/13/more-on-creative-financing-for-green-businesses/

Thanks– Leah

Sarah, good to see you again online. I’m associated with Recycled Energy Development, a company that does combined heat & power projects of the kind that BofA just installed. I’m not well versed enough on these other issues to judge the company’s work overall, but recycling energy — generating power and then using the excess heat to warm the building and create still more power — is absolutely critical to the success of any efforts to reduce global warming. So I commend them for that.

Sarah, good to see you again online. I’m associated with Recycled Energy Development, a company that does combined heat & power projects of the kind that BofA just installed. I’m not well versed enough on these other issues to judge the company’s work overall, but recycling energy — generating power and then using the excess heat to warm the building and create still more power — is absolutely critical to the success of any efforts to reduce global warming. So I commend them for that.