Whenever you take out a loan the temptation is to imagine a big mountain of money in a secure vault somewhere.

Your friendly bank manager, a nice affable chap, is on hand doling out credit to any soul who can jump through his hoops.

This is miles, no decades, away from the truth. Here’s how debt works today ….

In order to lend money, banks have to borrow it from another bank. Usually, that bank has also borrowed it from another bank … and so the borrowing continues.

As collateral for these loans many banks put up their assets. Many of these assets are themselves funded by loans.

Some are even bundles of loans, grouped together to allow the income generated through the loans’ repayments to be considered an asset.

So what you end up with if you seek debt advice in the UK in the end is a pile of debts, each secured against another. As the pile rises the whole structure becomes shakier and shakier, making the architecture of the whole system riskier and riskier. Not what a good economist wants to hear.

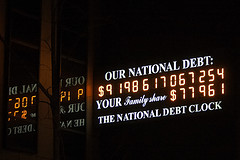

America In Debt

In case you don’t believe me, here are some figures for the USA in 2007:

- total value of all goods and services produced: $13.5tr

- total amount of money in circulation: $0.57tr

So half a trillion dollars has somehow funded 13 trillion dollars worth of economic activity? Get real!

This is a leverage factor of around 20:1 … some banks had been leveraging their assets at up to 40:1. In the meantime, Ordinary Joe, when buying a house is only allowed a leverage factor of 3:1.

Man! If I could leverage my income at 40:1, I’d be buying my senator’s house! Wow .. the common man lives in a mansion. Or, more likely…..

…. this is utter madness!! It’s like driving a car faster and faster and faster because you haven’t reached the bend in the road yet. When that bend arrives, you’re going too fast and there’s a huge and bloody car crash. Period.

Better Rules For The Economy

So let’s get three things straight in our new economic architecture:

- Only money is money. It’s the common denominator in any economy, used to measure the value of all things. Only the Central Bank can create it.

- Assets are items which may be of value in the future. They can be offered as loan collateral but only (say) 80% of an asset’s value can be lent. Their imagined value cannot be called money.

- Debts are an absence of value, not the creation of money. They may not be considered assets and no institution’s debts may exceed their assets’ value (ie. a 1:1 gearing)

Do you agree with these points, or do you think they’re far liberal or restrictive? Or can you think of something which needs to be added to next week’s topic: competition and growth?

Either way, I always enjoy hearing your views and discussing them with you.

Don’t be shy! Post a comment below or start a thread on the Green Options Discussion Forum!

Related Posts:

Is Your Money Safe Where It Is? What About Green Stocks?

Wealth and Value : New Economic Architecture Required

Lehman Brothers Collapse: New Economic Architecture Required

Picture Credit: “National Debt” by Digiart2001 from Flickr under Creative Commons Attribution Share Alike Licenese.

Great analysis! It is pretty crazy that we have got to the point where our entire economy depends on everyone being in debt.

Great analysis! It is pretty crazy that we have got to the point where our entire economy depends on everyone being in debt.

Miranda — your hear it every day on the TV: “The market is in crisis because the banks can’t lend to each other”. WOW (or is that WTF?!) Chris.

Miranda — your hear it every day on the TV: “The market is in crisis because the banks can’t lend to each other”. WOW (or is that WTF?!) Chris.

Am…..

Are we not forgetting something here?

Doesn’t usury figure into your equation at all?

Am…..

Are we not forgetting something here?

Doesn’t usury figure into your equation at all?

Anon23 — elephant in the corner — well spotted!

For the purposes of this post I want to remain studiously neutral on the point of usury.

However it has no bearing on the main thrust of the post, as any profit (or loss) made through usury is bundled up as part of the “goods and services” which make up GDP.

Chris.

Anon23 — elephant in the corner — well spotted!

For the purposes of this post I want to remain studiously neutral on the point of usury.

However it has no bearing on the main thrust of the post, as any profit (or loss) made through usury is bundled up as part of the “goods and services” which make up GDP.

Chris.

I actually disagree with your first point. Money should NOT be only created by a central bank. It should be free to be created and used at will by citizens and private institutions. Giving a monopoly over creation of money into the hands of unelected bankers is what has given us the current credit crisis. The free market where money and credit is created by individual banks is a much more acceptable alternative. It leads to a freer society, where money is the servant of the people, rather than their master.

I actually disagree with your first point. Money should NOT be only created by a central bank. It should be free to be created and used at will by citizens and private institutions. Giving a monopoly over creation of money into the hands of unelected bankers is what has given us the current credit crisis. The free market where money and credit is created by individual banks is a much more acceptable alternative. It leads to a freer society, where money is the servant of the people, rather than their master.

Just my two cents: the U.S. sub-prime mortgage crisis was the most “sensible” thing that happened. Banks kept on making risky home loans and thereby turning their cash asset into the riskier assets. On the consumer side, with a variable rate, soon their payments on their mortgages become ridiculously high. Why not default since it’s the much cheaper alternative. With the housing bubble, they had been able to refinance their homes and essentially “selling” their homes for a value far exceeding the true value of their houses.

Of course, the banks package these risky assets and sell them off to others. As the cycle perpetuated, liquidity essentially disappeared since no cash was flowing in…

What a time to be in history!

Just my two cents: the U.S. sub-prime mortgage crisis was the most “sensible” thing that happened. Banks kept on making risky home loans and thereby turning their cash asset into the riskier assets. On the consumer side, with a variable rate, soon their payments on their mortgages become ridiculously high. Why not default since it’s the much cheaper alternative. With the housing bubble, they had been able to refinance their homes and essentially “selling” their homes for a value far exceeding the true value of their houses.

Of course, the banks package these risky assets and sell them off to others. As the cycle perpetuated, liquidity essentially disappeared since no cash was flowing in…

What a time to be in history!

The rate of circulation of the money available matters. A given amount of money circulating at a fast enough rate can fund more production than its value. The total amount of money available only needs to match the rate of transactions, not the total value produced.

The rate of circulation of the money available matters. A given amount of money circulating at a fast enough rate can fund more production than its value. The total amount of money available only needs to match the rate of transactions, not the total value produced.

@Guy Fawkes: Money is free to be created by private citizens, however it is not ‘legal tender’, i.e. good for the payment of taxes and settlement of debts. IMO, legal tender must be controlled by an issuing authority, most preferably an institution bound by regulation or a physical asset to dollar relationship (like the gold standard) to guard against inflation and abuse in issuance. The tally stick and Colonial Scrip, although fiat, were successful because they were government issued and just enough was supplied to facilitate trade. So anything that sticks to a moderate policy of ‘just enough’ can work.

The creation of checkbook money through fractional reserve lending is not necessarily evil. If banks were required to keep a 1:1 ratio (50% reserve), the interest charged would likely be quite high, even in a competitive market. This would certainly hamper responsible growth. That said, i do believe reserve ratios need to be enforced strictly. Something along the lines of 15-20% seems reasonably pro-growth, without dangerous over-leveraging.

Unfortunately, SEC actions lifted the 10% reserve requirement in ’04 for a select few banks whose names you’ll recognize. This removed stability for the sake of soaring profits on a knife’s edge: http://www.nytimes.com/2008/10/03/business/03sec.html

This, combined with the irresponsible actions of lenders and borrowers, combined with the repeal of Glass-Steagall, combined with the subsequent creative ‘packaging’ of debt has lead us to this… a financial disruption at best, a catastrophe and end of our modern era of banking at worst. Or is that best… I’m not sure 🙂

@Guy Fawkes: Money is free to be created by private citizens, however it is not ‘legal tender’, i.e. good for the payment of taxes and settlement of debts. IMO, legal tender must be controlled by an issuing authority, most preferably an institution bound by regulation or a physical asset to dollar relationship (like the gold standard) to guard against inflation and abuse in issuance. The tally stick and Colonial Scrip, although fiat, were successful because they were government issued and just enough was supplied to facilitate trade. So anything that sticks to a moderate policy of ‘just enough’ can work.

The creation of checkbook money through fractional reserve lending is not necessarily evil. If banks were required to keep a 1:1 ratio (50% reserve), the interest charged would likely be quite high, even in a competitive market. This would certainly hamper responsible growth. That said, i do believe reserve ratios need to be enforced strictly. Something along the lines of 15-20% seems reasonably pro-growth, without dangerous over-leveraging.

Unfortunately, SEC actions lifted the 10% reserve requirement in ’04 for a select few banks whose names you’ll recognize. This removed stability for the sake of soaring profits on a knife’s edge: http://www.nytimes.com/2008/10/03/business/03sec.html

This, combined with the irresponsible actions of lenders and borrowers, combined with the repeal of Glass-Steagall, combined with the subsequent creative ‘packaging’ of debt has lead us to this… a financial disruption at best, a catastrophe and end of our modern era of banking at worst. Or is that best… I’m not sure 🙂

Interesting concept. I have disagree with:

Assets are items which may be of value in the future. They can be offered as loan collateral but “only (say) 80% of an asset’s value can be lent.” Their imagined value cannot be called money.

This would prevent the economy from growing or development from occurring. For any type of development to occur, land, intellectual, etc. the asset must be valued at it’s potential value and collateralized based on the lender’s appetite for risk. And of course the lender’s return is directly related to the risk. Now this level of risk not appropriate security for all deposits.

Now, regardless of your opinion on collateral, assets, or interest rates. There is a fundamental rule that must be followed. Do not loan money to persons who cannot reasonably service the debt.

Interesting concept. I have disagree with:

Assets are items which may be of value in the future. They can be offered as loan collateral but “only (say) 80% of an asset’s value can be lent.” Their imagined value cannot be called money.

This would prevent the economy from growing or development from occurring. For any type of development to occur, land, intellectual, etc. the asset must be valued at it’s potential value and collateralized based on the lender’s appetite for risk. And of course the lender’s return is directly related to the risk. Now this level of risk not appropriate security for all deposits.

Now, regardless of your opinion on collateral, assets, or interest rates. There is a fundamental rule that must be followed. Do not loan money to persons who cannot reasonably service the debt.

Air, water, family, food, shelter are the only real wealth. (Maybe there’s a couple of others.) This financial fiasco is built on fantasies of making money work.

Your body mind and soul need labor, not sitting around wondering about numbers and how to highjack profits.

Oh our Nation of fabricated wealth! How far could 700 billion go to give real help to real people, instead of rescuing the confidence of the already too entitled?

Air, water, family, food, shelter are the only real wealth. (Maybe there’s a couple of others.) This financial fiasco is built on fantasies of making money work.

Your body mind and soul need labor, not sitting around wondering about numbers and how to highjack profits.

Oh our Nation of fabricated wealth! How far could 700 billion go to give real help to real people, instead of rescuing the confidence of the already too entitled?

Oh let me be more to your point.

1. Money is money only in an economic system where we trade goods or services abstractly. After a great collapse, we won’t need money. Work for a living.

2. Assets have value now. That’s all I need to know. My house only pretends to grow in value. To me it’ll never really be worth more…that’s an artificial economic concept.

3. Debt is a fantasy, an agreed upon one that only has value as long as an infrastructure (and guilt mechanism) holds up.

I like your shift however. It’s much more responsible than the current visions of cash flow.

Oh let me be more to your point.

1. Money is money only in an economic system where we trade goods or services abstractly. After a great collapse, we won’t need money. Work for a living.

2. Assets have value now. That’s all I need to know. My house only pretends to grow in value. To me it’ll never really be worth more…that’s an artificial economic concept.

3. Debt is a fantasy, an agreed upon one that only has value as long as an infrastructure (and guilt mechanism) holds up.

I like your shift however. It’s much more responsible than the current visions of cash flow.

@everyone: thank you so much for your comments; a real pleasure to have watched the discussion grow and hear everyone’s different opinions. Please keep on going!

A few specific replies:

@BobR: you’re right about the circulation which is why I (admittedly on my own calculations) chose a gearing of 20:1. If anyone has some firm figures anywhere I’d be delighted to hear them.

@GuyFawkes & @Mike: it’s not that long ago we had local banks issuing their own local tender. Is this what you have in mind? We’re sort of getting back to that with Wedge Cards (http://www.wedgecard.co.uk/)

@Steven: right back at you 🙂 I was pondering today how our fixation with measuring everything financially is basically an obsession with numbers. More .. some other time I think!

I’m also intrigued by the number of people I hear (I mean just in general) saying we still need to take risks in order to create profits. Really?

@everyone: thank you so much for your comments; a real pleasure to have watched the discussion grow and hear everyone’s different opinions. Please keep on going!

A few specific replies:

@BobR: you’re right about the circulation which is why I (admittedly on my own calculations) chose a gearing of 20:1. If anyone has some firm figures anywhere I’d be delighted to hear them.

@GuyFawkes & @Mike: it’s not that long ago we had local banks issuing their own local tender. Is this what you have in mind? We’re sort of getting back to that with Wedge Cards (http://www.wedgecard.co.uk/)

@Steven: right back at you 🙂 I was pondering today how our fixation with measuring everything financially is basically an obsession with numbers. More .. some other time I think!

I’m also intrigued by the number of people I hear (I mean just in general) saying we still need to take risks in order to create profits. Really?

Please tell me something. Where is the money? As far as I can see someone sold securities which are now worthless or near worthless to someone else. Now if you sell me a car which turns out to be a lemon i would come and get my money back from you – yes? So as I see it someone has been paid and is sitting on a pile of cash and the suckers are holding onto a piece of paper that nobody wants. Now this bailout is like a third party – the taxpayer (via the government) refunding me for the lemon and the guy that sold it to me gets to keep my money. Is this correct? If so who is the guy that sold me the lemon and why can’t the money be retrieved from him? TIA GG

Please tell me something. Where is the money? As far as I can see someone sold securities which are now worthless or near worthless to someone else. Now if you sell me a car which turns out to be a lemon i would come and get my money back from you – yes? So as I see it someone has been paid and is sitting on a pile of cash and the suckers are holding onto a piece of paper that nobody wants. Now this bailout is like a third party – the taxpayer (via the government) refunding me for the lemon and the guy that sold it to me gets to keep my money. Is this correct? If so who is the guy that sold me the lemon and why can’t the money be retrieved from him? TIA GG

It’s all an illusion – pushing and trading paper for property or companies that have unreal values. American has created a new class of workers – the “Use Less Class” of workers in the middle of transactions; broker, buyers, sellers and paper shufflers on all levels.

Manufacture – or go hungry.

(plug)

otoyk.com

sustainable driving directions

It’s all an illusion – pushing and trading paper for property or companies that have unreal values. American has created a new class of workers – the “Use Less Class” of workers in the middle of transactions; broker, buyers, sellers and paper shufflers on all levels.

Manufacture – or go hungry.

(plug)

otoyk.com

sustainable driving directions

The big bankers wanted profit that translated into BONUS. They said, “why not? Ot ain’t our money we are risking.”

Thus, no reason not to!

@Greg — here’s the funny part, there’s no security in securities. Everyone is supposed to understand that they’re a risk: all the ads try and make out that they’re guarantees.

@Brewse — horrifyingly true.

@Jack — also, here’s the great problem with performance related bonuses: get out before the effects of you bad decisions are felt. What a world.

@Greg — here’s the funny part, there’s no security in securities. Everyone is supposed to understand that they’re a risk: all the ads try and make out that they’re guarantees.

@Brewse — horrifyingly true.

@Jack — also, here’s the great problem with performance related bonuses: get out before the effects of you bad decisions are felt. What a world.

The US dollar is fortunate to be the world’s reserve currency and the government can afford to print more money to finance their debts without other countries balking. Iceland will wish to be in such a position.

Due to their status, US also get better deals when they are seeking out loans from other institutions.

You are right to bring up the point of extreme leverage. It is a pity that the US government failed to save up during the fat years and now when there is a recession, it can only raise more debts to finance any stimulus plans.

Nevertheless, I am a firm believer that cutting back on debts right now is not a wise decision. In fact, increased government spending to improve the circular flow of money is necessary.

http://jeflin.net/2008/11/13/spend-our-way-out-of-recession/

The US dollar is fortunate to be the world’s reserve currency and the government can afford to print more money to finance their debts without other countries balking. Iceland will wish to be in such a position.

Due to their status, US also get better deals when they are seeking out loans from other institutions.

You are right to bring up the point of extreme leverage. It is a pity that the US government failed to save up during the fat years and now when there is a recession, it can only raise more debts to finance any stimulus plans.

Nevertheless, I am a firm believer that cutting back on debts right now is not a wise decision. In fact, increased government spending to improve the circular flow of money is necessary.

http://jeflin.net/2008/11/13/spend-our-way-out-of-recession/

I must say that your own blog is particularly informative. I’ve been just spending plenty of free time over the last couple months seeking at precisely what is out there in accordance with the fact that I’m arranging to launch a blog page. The details you have place on here is essentially to the point. It just is likely so difficult to understand when it comes to all the technologies that are out there, but I like the way your is visually. Gotta absolutely adore where technological innovation has come during the previous twelve yrs.

I must say that your own blog is particularly informative. I’ve been just spending plenty of free time over the last couple months seeking at precisely what is out there in accordance with the fact that I’m arranging to launch a blog page. The details you have place on here is essentially to the point. It just is likely so difficult to understand when it comes to all the technologies that are out there, but I like the way your is visually. Gotta absolutely adore where technological innovation has come during the previous twelve yrs.