As the G20 leaders gather in Washington for what has been dubbed “Bretton Woods II”, here’s a brief list of the economic opportunities they need to discuss:

The World’s population is estimated at 6.7 billion:

- of this, 15% live in slums and are permanently hungry

- yet the USA, the EU, the UK, Russia, China, India and Brazil have all reported bumper harvests this year

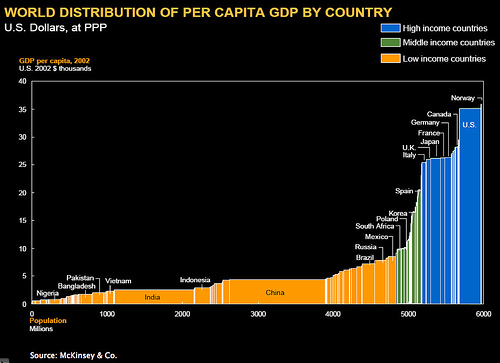

The World’s GDP is estimated at $55.5tr per annum:

- of this 85% is consumed by 20% of the population

- while 45% of the population live on around $900 per annum

- and 0.0001% of the population have a combined wealth of over $10tr

In the USA, in the ten years to 2006:

- employment stayed at around 72%

- while average earnings rose 45% from $37,000 to $54,000

- and the average real income of the poorest 20% of households fell

In other words, the global economy is fixed in a spiral where prosperity is hoarded by those who already have and isn’t shared with those who already have not. Social mobility is non-existent.

The G20’s Historic “Bretton Woods” Opportunity

Corporations’ historical reluctance to engage with the vast market of the poor has been driven largely by the fact they cannot make as much profit from it as they can by segmenting the wealthy market.

However, with the advent of CSR many companies are starting to understand that the pursuit of ever greater profit is not, in and by itself, a wholesome goal. Now is the time to put that understanding into action.

So the will is there and the market is there. All the Bretton Woods II governments in Washington need to do is establish the institutions to bring the two together.

In 1932, over ten years before the original Bretton Woods conference, John Maynard Keynes, wrote the following in the New Statesman:

The delegates to the World Conference should assemble in sackcloth and ashes, with humble and contrite hearts. … Fear and greed, duplicity and incompetence, but above all conventional thought and feeling, have brought their collective performance far below the level of the participants regarded as human individuals. But here is a last opportunity.

The question is, will that opportunity be taken? Or will it take another ten years for the world to put it’s house in order?

What do you think about the Future Financial Architecture?

Is the G20 meeting a historic opportunity to remould financial architecture in a more socially responsive and responsible framework?

Can previously “irresponsible” corporations be trusted to enact this through the free market, or should we be “once bitten, twice shy” and demand strong regulation?

Please share your thoughts below: let’s see what we can come up with!

Photo Credit “World Distribution of Per Capita GDP By Country” by Wesley Fryer from Flickr under Creative Commons Attribution Share Alike License.

I agree with your sentiments but with a lame duck US president attending the G20 meeting, I think there is little of substance that will be achieved. World leaders are waiting for Obama’s administration to start real negotiations.

I agree with your sentiments but with a lame duck US president attending the G20 meeting, I think there is little of substance that will be achieved. World leaders are waiting for Obama’s administration to start real negotiations.

Why doesn’t the US Government create it’s own currency debt free instead of being charged.

Why doesn’t the US Government create it’s own currency debt free instead of being charged.

Another potent article Chris. Thanks for the myriad links and the succinct post.

Another potent article Chris. Thanks for the myriad links and the succinct post.

Thanks for the comments everyone

@Stephen, I’m really glad you’re enjoying the articles, thank you.

@Dave — you introduce an interesting thread. Leaving specific conversation on the Amero to one side, is there scope for the dollar to start being used *officially* in other countries?

@Andy — Elephant in the room, the lame duck. I think the US needs to be very careful in coming years: it has consistently avoided leadership around sustainability. If it’s not careful the World may get fed up with waiting and start following others.

What do other people think? Would western countries really turn to another country / currency for leadership and strength?

Thanks for the comments everyone

@Stephen, I’m really glad you’re enjoying the articles, thank you.

@Dave — you introduce an interesting thread. Leaving specific conversation on the Amero to one side, is there scope for the dollar to start being used *officially* in other countries?

@Andy — Elephant in the room, the lame duck. I think the US needs to be very careful in coming years: it has consistently avoided leadership around sustainability. If it’s not careful the World may get fed up with waiting and start following others.

What do other people think? Would western countries really turn to another country / currency for leadership and strength?

I do not think that government can regulate charity. This shake-up in our economy may present these poor populations as profitable for corporations, and possibly with this profitability and outreach into these places standards of living will increase. And with success and more prosperity there will surely be those who dedicate their lives to service; truly those already exist in these less fortunate places. Let those with more pure and loving hearts than mine be the stewards of charity and opportunity. None of the poor will be served well by bureaucrats or governments. And not to seem cold, but I must worry about our own house more than that of those living beyond our boards. In a time of this kind of crisis it is hard for me to look beyond my family, friends, and my paycheck.

I do not think that government can regulate charity. This shake-up in our economy may present these poor populations as profitable for corporations, and possibly with this profitability and outreach into these places standards of living will increase. And with success and more prosperity there will surely be those who dedicate their lives to service; truly those already exist in these less fortunate places. Let those with more pure and loving hearts than mine be the stewards of charity and opportunity. None of the poor will be served well by bureaucrats or governments. And not to seem cold, but I must worry about our own house more than that of those living beyond our boards. In a time of this kind of crisis it is hard for me to look beyond my family, friends, and my paycheck.

Where is the Harvest produced in India Going then?? A lot of slums in India are having children who cannot have daily one time food. is it really the worlds economy growing??

Where is the Harvest produced in India Going then?? A lot of slums in India are having children who cannot have daily one time food. is it really the worlds economy growing??