Clearly there’s a significant, “soft conflict” currently being waged between the US and China. First we had the currency devaluation issue which many feel has led to the US/China trade imbalance. Humanitarian and environmental issues have often been a concern of the US in regards to China (although we could probably use a watchdog in those areas too), and now we have the ongoing battle over energy concerns, specifically those of the rare earth metals. China is resoundingly the leader in rare earth development and exportation (a crown the US once held) and the country has vowed to cut back on exports to preserve the supply and conserve the environment (?).

Clearly there’s a significant, “soft conflict” currently being waged between the US and China. First we had the currency devaluation issue which many feel has led to the US/China trade imbalance. Humanitarian and environmental issues have often been a concern of the US in regards to China (although we could probably use a watchdog in those areas too), and now we have the ongoing battle over energy concerns, specifically those of the rare earth metals. China is resoundingly the leader in rare earth development and exportation (a crown the US once held) and the country has vowed to cut back on exports to preserve the supply and conserve the environment (?).

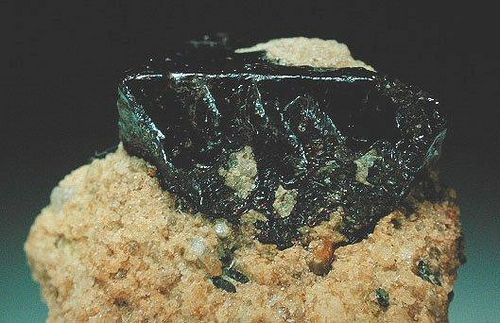

If you’re not familiar with the rare earths, you’re probably not alone. They are a group of 17 elements found on your high school chemistry periodic table. What are these elements/metals used for and how rare are they? Well, not surprisingly, the rare earths are used for the majority of our emerging technology/energy needs ranging from such items as semiconductors to batteries in hybrid/electric vehicles to wind turbines to toys the defense department likes such as night vision goggles and radar systems. Most likely it is the need for the latter devices that has the US government so concerned about China’s dominance in mining and trade for these metals.

As far as the rarity goes, the elements themselves are not entirely rare, but finding them in the form from which they can be processed is becoming a bit of a concern. Rare earths have been found throughout the world historically, including the US, which was once a significant producer, but currently, according to the US Geological Survey, China produces 97% of the world’s supply (however they only posses about 1/3 of the world’s reserves). Apparently, being beholden to the Chinese financially and the Saudi’s energy-wise is one thing, but combining the two under Chinese power will not stand.

Meanwhile, Mountain Pass, in Northern California was once the world’s leader in rare earth production and apparently the goal is to reclaim that crown. The plan is to do that through Molycorp, the only US company that has the capabilities of mining rare earths.

In the near term this is obviously a great concern for the both US/China relations and potential energy policy moving forward, even if it’s the DOD and US’s military complex that is really the concern of the US government. However, in the long term it’s the same old issue of reliance on our current energy sources (fossil fuels). Admittedly the environmental effects may not be as detrimental (although it’s impossible to determine at the moment), but even most “renewable” energy sources really rely on non-renewable components. In order for a suitable and comprehensive energy policy to be established in the United States, a serious balancing act will need to take place between the appropriate types of energy to be used and how we will find the appropriate resources to make such a policy effective.

Image Credit by commerceresources via Flickr under a CC license

It’s not only about energy. It also encompasses the economy as we

are only economic leaders because of our technology/efficiency. Most high

tech equipment uses RRE. A great stock play to profit on this trend is Cache

Exploration (Cay.V) on the tsx-venture X.

Still cheap unlike most REE companies(under a buck) like Molycorp

witch will have to mine for like 20 years just to break even for an investor at

current market Cap.