Having failed to reach an agreement with the Republican Party, the Democrats can create a stampede that drives the economy over the edge of the ‘fiscal cliff’, plunging the economy into recession, a fire sale that would wipe the slate clean and allow the democrats to reframe tax proposals.

Both outcomes have their benefits, but regardless of the result of negotiations over the next fiscal quarter, the investor, like Congress, faces some tough decisions. Neither outcome provides a clear directive for investment opportunities. When doing nothing is not an option for the personal investor, opportunities are still available for consideration.

There are proposals that present investors with the ability to buy time in unstable markets, so long as the fund management they are working with has access to the best technology and superior risk management facilities able to interpret changing global financial landscapes. One such idea, proposed by companies such as Fidelity UK, is that investors place their savings in holding accounts called ISA Cash Parks.

The idea is to create a haven for money in less than certain times, particularly relevant after the unsettling effects of an election battle.

So what is a Cash Park ISA?

1) The ISA Cash Park offers a high level of control, allowing the saver to make the most of their ISA allowance and then defer their investment to a later date.

2) Opening an ISA is at the savers discretion and can be accessed whenever, with no tax payable at its withdrawal.

3) Savings invested into the Cash Park ISA remain within the tax wrapper.

4) It is available for both new money, or to switch existing investments.

5) Interest is paid monthly at 0.2% below the Bank of England bank rate (subject to a 20% charge to HM Revenue & Customs)

6) The degree of flexibility means that the investor can manoeuvre through an unstable financial landscape until the market settles and investor confidence returns.

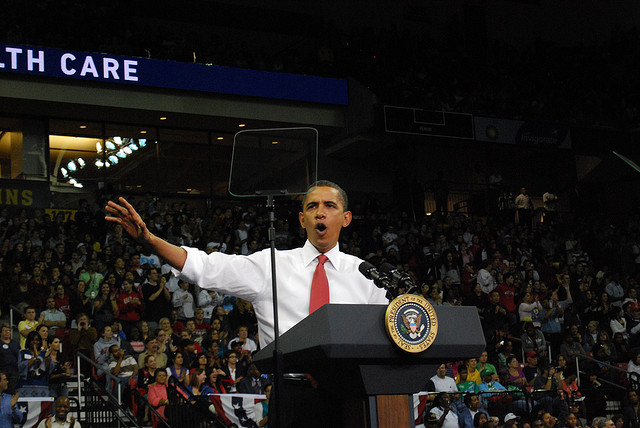

Although congressmen on both sides of the bi-partisan divide are working towards solving the bigger questions facing the American economy, there are no clear indicators of a solution on the horizon at present. As investors contemplate slow global growth, the first year of Obama’s Administration could be difficult, while the second full term might see steady improvement to stocks and shares.

This may prompt Investors to find a haven to ride out the storm of uncertainty, in order to be well placed to capitalise when the market eventually recovers.

It was a bold assertion by President Obama to suggest that the ‘best is yet to come’. Nonetheless, there will be many global investors who will be hoping that his success at the voting booths will mirror their success in the marketplace.

The eligibility to invest in an ISA will depend on individual circumstances, and all tax rules may change in the future. It should always be remembered that the value of investments can go down as well as up and you may get back less than you invested.