Data Visualization Definition

Data visualization is a graphical representation of information and data, utilizing elements such as charts, graphs, and maps, to provide an accessible way to see and understand trends, outliers, and patterns in data. It enables abstract data to be processed, analyzed and inferred by the human mind quickly and efficiently.

Importance of Data Visualization in Finance

In today's finance sector, the value of data visualization simply cannot be understated. Through the use of graphs, charts, and other visual representation tools, it assists in making sense of raw, complex financial data, converting them into a format that is accessible and easily understandable.

Improving Comprehension of Complex Data

Wading through dense financial data can be a challenging task. Pages filled with lines of numbers, percentages, decimals, and more can easily become confusing and overwhelming. This is where data visualization shines. By translating numbers into visual representations, it allows the brain to digest information more effectively, improving comprehension and perceptual speed.

Aiding Decision-Making

Decisions in finance must be data-driven to minimize risks and maximize returns. Here too, data visualization plays a vital role. Visual presentation of data can help identify trends, patterns, and correlations that may not be apparent in textual or numerical format. For instance, a line chart of stock prices over time may quickly show an upwards or downwards trend, aiding investors in making decisions to buy or sell.

Enhancing Speed and Efficiency

Time plays an integral role in finance, where split-second decisions can result in significant gains or losses. Processing numerical or textual data can be slow and time-consuming. Data visualization, however, can eliminate this bottleneck, providing essential insights swiftly and accurately.

Providing an Overview and Drilling Down

Data visualization not only provides a high-level overview of financial data but also allows for detailed analysis. With interactive visualizations, users can drill down to aspects that interest them, helping focus on critical components and dismiss irrelevant information.

Facilitating Communication

Additionally, data visualization can also act as a communication tool, making it easier to convey financial data, analysis, and insights to others. A well-designed graph or chart can eliminate language barriers, delivering a clear, concise message and ensuring everyone is on the same page.

In summary, data visualization is a powerful tool in the realm of finance. By enhancing comprehension, speeding up processing, aiding decision making, allowing detailed analysis, and facilitating communication, it proves instrumental in navigating the complexities of financial data effectively. It supports finance professionals in their quest for optimization and efficiency, leading to more informed, data-driven decisions.

Techniques and Types of Data Visualization in Finance

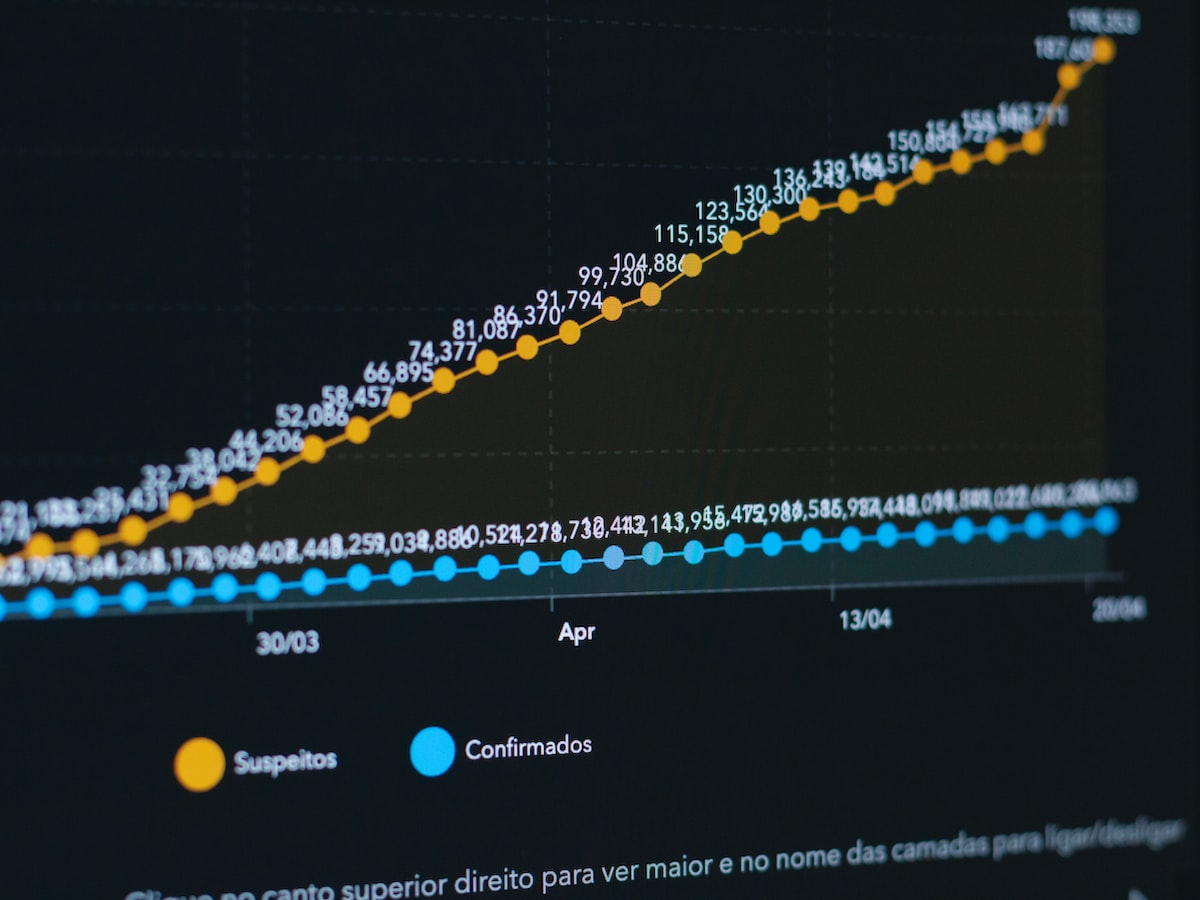

Line Graphs

These are vital in finance for tracking changes over time. They excel at showing trends and can show multiple sets of data simultaneously. Their numeric and time axes make it easy to see a chronological progression. For example, a line graph can illustrate the performance of a stock over a distinct period.

Bar Charts

These are useful in comparing different groups or communicating changes over time with categories that don't need to be in a specific sequence. In finance, they display data like revenue, expenses, and profits for various years or quarters. Horizontal bar charts are particularly useful when category labels are long or there are many categories.

Heat Maps

These are 2D visual representations of data using color gradients. In finance, heat maps are utilized to show volume, performance, or pricing information for groups of securities. They can show complex financial data in a snapshot, which is easier for users to understand. For example, a heat map can be used to show the performance of sectors in the stock market, with colours showing percentage change.

Scatter Plots

These plots come in handy when identifying the correlation between two variables, allowing financial analysts to determine their relationship. They plot data along two axes, representing value pairs per data point. For example, scatter plots can show the relationship between risk and return for different investment assets. They can have trendlines, which help to identify and interpret correlation visually.

Role of Data Visualization in Financial Analysis

Data visualization serves as a significant tool for financial analysts when dealing with substantial amounts of data. It provides a method for simplifying complex concepts and volumes of figures, making them accessible and understandable.

Simplifying Complex Data

In the realm of finance, analysts often have to work with large sets of data, navigating through seas of numbers and variables. Here, data visualization steps in to transform complicated numerical data into visually appealing and easily readable formats such as graphs, plots, charts, and infographics. This helps in digesting information in a clear and straightforward manner.

Interpreting financial reports and spreadsheets might require trained skills and education. But with data visualization, complex data sets can get translated into visual representations that are easily understandable. This makes complex data accessible not only to professionals but also to a general audience. It ensures no misinterpretation, which can have significant implications, especially in financial decision making.

Showcasing Valuable Insights

Another critical utility of data visualization in financial analysis is the ability to draw out valuable insights from raw numbers. An analyst can spot patterns, trends, and correlations that might go unnoticed in text-based data. These can help in identifying anomalies, outliers, or potential opportunities, which are crucial in the world of finance and investments.

Enhancing Strategic Planning

Data visualization also plays an integral part in strategic planning in the financial sector. Financial analysts, executives, and investors rely on these visual tools to interpret data and make strategic decisions. For instance, stock market trends can get easier to understand when there are charts representing them. Similarly, budget allocation and investments can be better managed with the help of pie-charts or bar graphs, promoting efficient decision-making.

Overall, data visualization is truly a bridge between raw data and understandable information, providing an essential tool for financial analysts. With its help, intricate data becomes approachable, insights become detectable, and strategic planning is enhanced.

Benefits and Limitations of Data Visualization in Finance

Beyond the common understanding of data visualization, applying this technique in the financial world can bring both meaningful benefits and unavoidable limitations. Navigatively, it is essential to identify and understand these points so that we can effectively maximize the advantages while minimizing the potential caveats.

Benefits of Data Visualization in Finance

Instant Interpretation of Financial Patterns

The most considerable vantage point from data visualization lies within its ability to transform complex financial data into visually intuitive figures, such as bar graphs or scatter plots. This transition allows for a quick interpretation of the underlying data and trends, reducing the time required by traditional tabulated or text-based information.

Simplified Decision-Making Process

Another significant advantage is that complex financial decisions are often simplified through visual data presentation. Visualized data can illustrate patterns and relations in data that might escape notice in text-based data presentation. This ability makes it an essential tool in strategic decision-making processes.

Limitations of Data Visualization in Finance

However, for all its worth, data visualization does have its fair share of limitations when applied to financial contexts.

Reliance on Quality Data

One of the potential shortcomings is the dependency on the quality of the raw data. If the initial data is misinterpreted or suffers from discrepancies, this will be mirrored in the visual representation. Due to their visually compelling nature, these errant charts can inadvertently mislead users into making inaccurate decisions.

Complexity of Financial Data

Additionally, the complexity and meticulousness of financial data may often mean that some nuanced but critical information gets lost in translation to simpler visual forms. It may also lead to oversimplification, giving financial decisions based on these visual representations a potential risk.

Maximizing Benefits and Mitigating Limitations

The above challenges notwithstanding, there are ways to maximize the benefits and mitigate the drawbacks of data visualization in finance.

Use of Quality Data Sources

Ensuring the utilization of accurate, reliable, and quality data sources reduces the chances of erroneous interpretations drastically. This step is crucial as the entire concept of data visualization in finance builds upon the principle of true and dependable data.

Combine with Detailed Analysis

While data visualization simplifies complex data, it should complement—not replace—detailed financial analysis. A combination of visual representation and textual interpretation can significantly improve decision-making processes and minimize the risk of losing critical information in data translation.

Remember, as with any tool or technique, the precise employment of data visualization within finance can yield its many benefits, while a mindful approach can manage and diminish its limitations. By marrying visualization with comprehensive data and careful interpretation, we can ultimately make the most sophisticated financial decisions.

Data Visualization and Corporate Reporting

Data Visualization can play a pivotal role in corporate financial reporting, as it can significantly improve and streamline the process of interpreting complex data. One of the key benefits it offers is the ability to simplify intricate financial information, making it easily understandable for a wide range of audience. By transforming raw financial data into visual forms like graphs, charts, infographics, etc., decision-makers can instantly comprehend the trends, correlations, and patterns that would otherwise require extensive time and effort to interpret.

Improving Clarity in Financial Reports

Data visualization techniques help to convert complex financial data into an easily comprehended format. It can condense extensive spreadsheets filled with numbers into a single visual representation, which can clearly highlight the prominent points or trends. This not only makes financial reports less intimidating but also allows stakeholders to quickly grasp the financial health and performance of the company in real-time.

Enhancing Transparency

Another significant advantage of using data visualization in financial reports is the potential to enhance transparency. It eliminates ambiguities and reduces the chances of misinterpretation of financial data. This transparency is particularly beneficial to external stakeholders as it allows them to make informed decisions regarding their investments or associations with the company.

Facilitating Better Corporate Governance

Effective corporate governance is dependent on accurate, timely and transparent information. By presenting data visually, directors and board members can easily understand the company’s financial position, aiding them in decision-making processes. Moreover, it allows companies to comply with the regulatory requirements of presenting clear and transparent financial statements in a more effective manner.

In summary, by facilitating an easily digestible, accurate representation of financial data, data visualization directly contributes to improved clarity and transparency in corporate reporting, and in turn, to better corporate governance.

Data Visualization: Impact on Sustainability Reporting

Data visualization plays a pivotal role in sustainability reporting by enhancing readability and understanding of complex sustainability data. It simplifies the presentation of such data, that often contains numbers in huge volumes, hence turning it into easily digestible information.

Making Sustainability Data More Understandable

Often, crucial information about a company's sustainability efforts gets lost or overlooked due to overly complex data presentation methods. Data visualization employs clear, vivid graphics to represent this data, thus ensuring that stakeholders and other interested parties grasp the message effectively. These visuals can range from simple charts and graphs to more complex heat maps and geospatial data representations.

Enriching CSR Communication

By leveraging data visualization in sustainability reporting, an organization can significantly enhance its Corporate Social Responsibility (CSR) communication strategy. Visuals have the power to communicate clearly and rapidly, which allows stakeholders to instantly grasp the essential principles of an organization's sustainability efforts. This, in turn, boosts the transparency, trust, and credibility of the organization, as well as fosters more informed decision-making among stakeholders.

Identifying Trends and Patterns

Moreover, data visualization techniques help to identify trends, patterns, and correlations within sustainability data sets that would have otherwise been challenging to detect. It aids in spotting outliers and potential issues that require attention, thus providing companies with the opportunity to take corrective measures promptly.

Driving Engagement

Data visualization can also drive more engagement from stakeholders. An interactive data visualization, for example, gives viewers the ability to customize their data exploration based on their specific interests or concerns. This reinforces stakeholder interest and engagement, thus strengthening stakeholder relations.

In conclusion, data visualization techniques can significantly enhance the presentation and understanding of sustainability reports. By distilling intricate sustainability data into accessible formats, data visualization promotes CSR and paves the way for a more sustainable future.

Data Visualization Tools in Finance

As we delve deeper into this topic, it becomes important to understand the various tools used in finance for data visualization.

Tableau

Tableau is one of the market leaders when it comes to data visualization tools. It is highly intuitive and user-friendly, making visualization a breeze. Tableau provides stellar interactive dashboards, real-time analytics, and has strong mobile support. Its applicability in finance is wide, from investment banking to insurance and risk management. Pricing varies from $70 to $85 per user/month, based on the package.

Microsoft Power BI

Power BI is Microsoft’s data visualization tool most famous for its seamless integration with other Microsoft products. Power BI boasts simplified data prep and drive ad hoc analysis. The tool provides real-time analytics, and custom data visuals. Financial services organizations can use Power BI to create powerful, interactive dashboards to visualize financial performance. Power BI’s pricing is on the lower side with options starting from $9.99 per user/month.

QlikView

QlikView, a flexible Business Intelligence (BI) platform, allows you to transform raw data into intuitive and interactive visual analytics. It’s unique for its Associative Model that enables users to probe all possible associations in their data across multiple sources. This is crucial in the finance industry for risk detection, asset management, or fraud identification. Pricing is not publicly available and requires a customized quote.

D3.js

D3.js (or Data-Driven Documents) is a JavaScript library that allows users to create accurate and interactive web-based data visualizations. It's favored by developers and data analysts for its flexibility and control. The main advantage is its zero cost as it is an open source tool. However, it may require some technical expertise and is not as easy to use as other tools.

Zoho Analytics

Zoho Analytics is a self-service BI and analytics platform that allows you to create easily understandable data visualizations and actionable dashboards. It offers Automated Insights, a Zia Assistant, and an Advanced Analytics connector for more detailed business insights. With finance, you can track your KPIs and tune up your financial strategies. It also has a variety of pricing plans starting from $25/month.

Each of these tools offer different features. Choosing the right tool often depends on your specific needs, budget, and the technical skills of your team.

Data Visualization and the Future of Finance

In interpreting the future of finance, data visualization stands as a paramount factor. Financial professionals are constantly in need of methods to interpret complex and copious amounts of data. Modern advancements in this domain are not only improving the simplicity and efficiency of this task but are also set to fundamentally alter the field of finance.

The Role of AI and Machine Learning

AI and Machine Learning (ML) significantly enhance the power of data visualization. With these technologies' aid, complex data can be simplified, patterns and correlations can be detected, and decision-making can become more efficient and accurate. Through advanced neural networks and machine learning algorithms, AI is empowering financial analysts to dissect massive datasets with precision.

For instance, ML can recognize and highlight relevant patterns and correlations within large datasets that a human might overlook. This can lead to new insights and perspectives that would ordinarily remain undiscovered. Consequently, the accuracy, efficiency, and speed of financial forecasting, decision-making processes, and risk assessment can be dramatically improved.

Big Data's Impact

The field of finance generates vast amounts of data daily. From stock prices to consumer spending habits, the range and quantity of financial data are simply staggering. When big data technologies are combined with advanced data visualization tools, this wealth of information can be more efficiently managed and interpreted.

Big data helps by partitioning colossal data sets into manageable chunks, assembling them in a structured format, and standardizing the data to ensure compatibility with various visualization tools. The integration of big data with data visualization provides a clearer overview of complex financial systems, including market trends and customer behavior patterns.

Real-time Data Visualization

Another forward-looking aspect is the advent of real-time data visualization. With virtually unlimited access to real-time financial data, the need for tools that can instantly interpret and present this data has become essential.

Real-time data visualization allows financial professionals to monitor financial markets, observe real-time changes, and make immediate decisions. Utilizing up-to-the-minute data, these methods enable a much closer and more immediate understanding of financial landscapes, potentially leading to quicker and more beneficial decision-making.

As we continue to make strides in AI, Machine Learning, Big Data, and real-time analytics, their integration with data visualization is undeniably shaping a new future for the finance industry. Bolstered by these powerful technologies, future finance could look starkly different – more efficient, accurate, and insightful.