Despite all the bad news we’ve received due to issues in the financial sector over the last two years, it turns out some banks are doing significant work greater than the occasional philanthropic project.

Despite all the bad news we’ve received due to issues in the financial sector over the last two years, it turns out some banks are doing significant work greater than the occasional philanthropic project.

Mark Stoiber of Fast Company has outlined some of these cutting edge banks and the interesting work they are doing in two articles, here and here. Typically, banks have been seen as less active in the CSR world than businesses in other sectors, despite their impressive profits and high quality of human capital. Stoiber’s second post, “Are You Ready for a Radically Sustainable Bank?” looks at two models in particular that seem to be bucking the “make money at any cost” standard that many believe banks subscribe to.

One upcoming financial institution in San Francisco is Good Bank, which is a model that includes striving for transparency in all facets of its business as well as moving forward technologically (banks seem notoriously slow in adopting useful technology) with plans to reward customers who bank in an environmentally sound manner such as using smart phone technology to make purchases. The goal is to reduce waste as well as help organize one’s personal finances through various available applications.

Boston-based, Wainwright Bank stresses investment in community projects. The bank has developed a comprehensive strategy around “socially responsible lending” and believes its customers are particularly concerned with who their money is being lent to. The company has $1 billion in assets, 50% of which is being used to fund projects within their community development lending program.

Each of these models may remind you of another little social banking initiative started by an enterprising young Bangladeshi in the early 1970’s named Muhammad Yunus. Yunus is the grandfather of the now widely popular world of microfinance and while microfinance is intended to provide small loans to people in developing countries that do not have access to formal avenues of financing, the above examples are proof that this can be done domestically and on a larger scale.

If there was ever a sector where the business model has barely changed over the last century, it’s finance, but as both heads of the private sector along with policy makers look at ways to “fix” the financial system, it appears as though the aforementioned business models may have a role to play. And perhaps we’ll have a future where banks aren’t demonized but are actually creating a tangible social value.

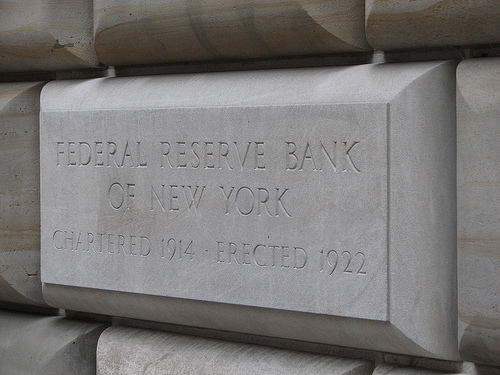

Image Credit by epicharmus via Flickr under a CC license