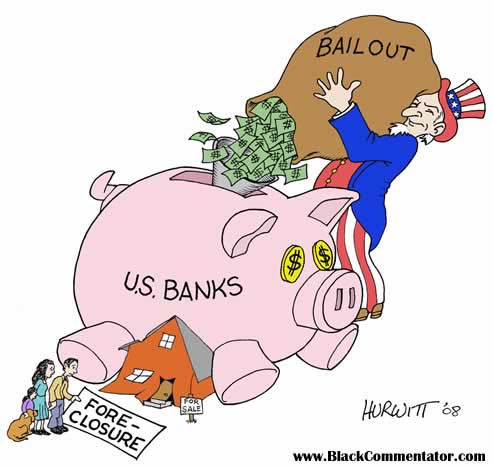

Sunday’s Financial Times has confirmed that the administration will be putting Wall Street banks through a “stress test.” The $2,000bn bank bailout plan was announced last week ahead of formal discussions with the industry’s representatives.

The bailout package includes financial assistance to purchase toxic assets from banks and a guarantee to cover some of the losses on those assets. And get this; the administration plans to buy convertible preferred shares in that need capital following the “stress test”. Now who could possibly blame Wall Street for being upset about this “creeping nationalization” of the banking industry?

The American public has expressed increasingly contentious views about the bank bailout situation. Now more then ever before there is talk about how President Obama’s victory came with a huge price tag…that of true capitalism. Now even though capitalism in the most modern economies has some degree of government interference, the question is how much interference will fuel industries vs. simply kill off what they bring to the table?

Everybody and their brother is up in arms about Wall Street bonuses. Now in an America with the democrats in power, one can hardly question that. But we are still missing opinion about those who believe that Wall Street might actually bring something to the table. That those guys with the big bonuses are not just pocketing cash without taking some massive risks. The risks that have built Wall Street to lay the foundation of a capitalistic empire that makes America so great in the first place. Anybody, like to comment?

And are the banks justified in thinking that the bailout stress test reeks of nationalism? Is Obama indeed the socialist that McCain pointed out during the campaign?

This is a large topic and opinions are bound to be diverse. Please send in your comments, as we would like to create a post that specifically features our reader contributions.

Credit Image: www.blackcommentator.com