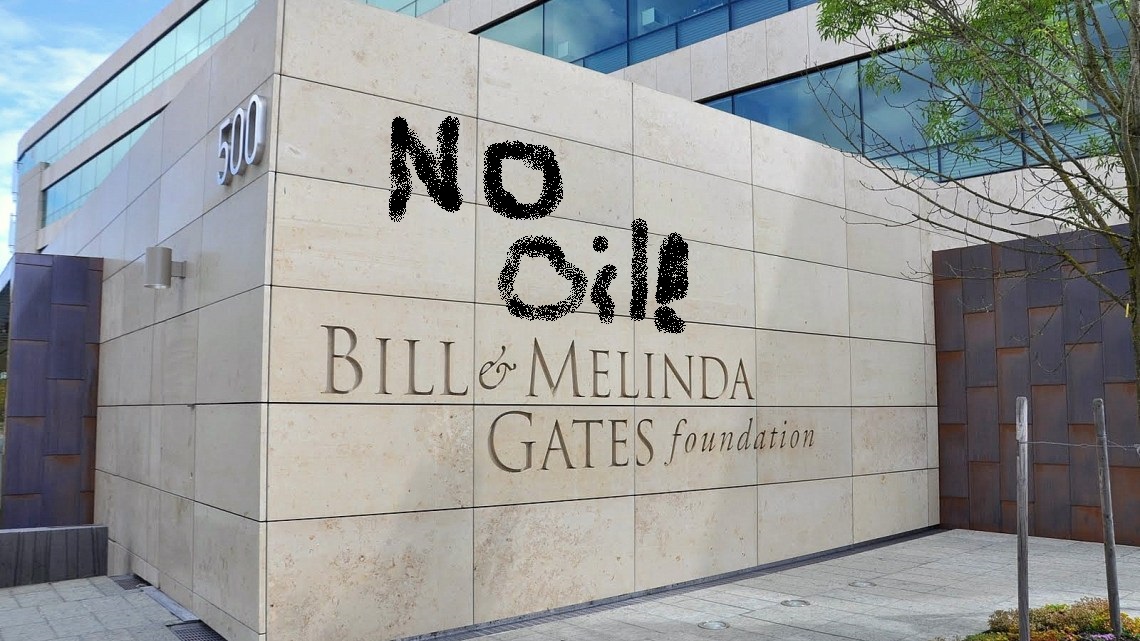

The Gates Foundation continues their disposal of fossil fuel equities. Between September and December, 2015, the Foundation “sold its $187m stake in BP.” This move follows a prior stock sale by the foundation to liquidate their entire $824 M holding in ExxonMobil.

This matters because as recently as October, Bill Gates is on the record against divestment as a tool to address climate change; going so far as to call it a “false solution”.

Why the change of heart? Clearly, we at the Inspired Economist do not imagine the Gates’ sitting at their Windows PC selling the stocks on an Etrade account. The foundation surely has some of the brightest investment minds managing their funds, and after seeing the Foundation would be “1.9 B better off if it had divested from fossil fuels in 2012″ they decided they could do better.

With the oil markets still lagging, natural gas at record lows (and getting new regulations), and coal unable to get a port to ship it to buyers outside of North America, who can blame them.