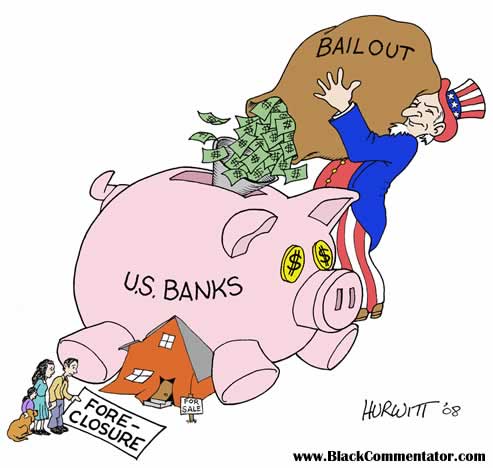

Bailout funds to fix the economy come at a higher cost to U.S. taxpayers.

Originally, the Congressional Budget Office had projected that last year’s $700 billion Troubled Asset Relief Program (TARP) would cost taxpayers $189 billion. With the new budget thrown in for 2009 and 2010, this figure has risen to $356 billion. (Reuters)

The Treasury Department has announced plans to use some of the money to help avoid home foreclosures and made new deals with Bank of America and the notorious American International Group (AIG).

On April 3, 2009, the Office of Management and Budget (OMB) published Implementing Guidance for the American Recovery and Reinvestment Act of 2009 (“Recovery Act”). This is the second installment of detailed government-wide guidance for carrying out programs and activities enacted in the Recovery Act. Read April 3 detailed guidance memorandum.

An Easily Understandable Explanation of Derivative Markets

Heidi is the proprietor of a bar in Sydney . She realizes that

virtually all of her customers are unemployed alcoholics and, as such,

can no longer afford to patronize her bar. To solve this problem, she

comes up with a new marketing plan that allows her customers to drink

now, but pay later. She keeps track of the drinks consumed in a ledger

(thereby granting the customers loans).

Word gets around about Heidi’s “drink now, pay later” marketing

strategy and, as a result, increasing numbers of customers flood into

Heidi’s bar. Soon she has the largest sales volume for any bar in

Sydney .

By providing her customers freedom from immediate payment demands,

Heidi gets no resistance when, at regular intervals, she substantially

increases her prices for wine and beer, the most consumed beverages.

Consequently, Heidi’s gross sales volume increases massively.

A young and dynamic Vice President at the local bank recognizes that

these customer debts constitute valuable future assets, and increases

Heidi’s borrowing limit. He sees no reason for any undue concern, since

he has the debts of the unemployed alcoholics as collateral.

At the bank’s corporate headquarters, expert traders transform these

customer loans into DRINKBONDS, ALKIBONDS and PUKEBONDS. These

securities are then bundled and traded on international security

markets. Naive investors don’t really understand that the securities

being sold to them as AAA secured bonds are really the debts of

unemployed alcoholics.

Nevertheless, the bond prices continuously climb, and the securities

soon become the hottest-selling items for some of the nation’s leading

brokerage houses.

One day, even though the bond prices are still climbing, a risk manager

at the original local bank decides that the time has come to demand

payment on the debts incurred by the drinkers at Heidi’s bar. He so

informs Heidi.

Heidi then demands payment from her alcoholic patrons, but being

unemployed alcoholics they cannot pay back their drinking debts. Since

Heidi cannot fulfill her loan obligations, she is forced into

bankruptcy. The bar closes and the eleven employees lose their jobs.

Overnight, DRINKBONDS, ALKIBONDS and PUKEBONDS drop in price by 90%.

The collapsed bond asset value destroys the banks liquidity and

prevents it from issuing new loans, thus freezing credit and economic

activity in the community.

The suppliers of Heidi’s bar had granted her generous payment

extensions and had invested their firms’ pension funds in the various

BOND securities. They find they are now faced with not only having to

write off her bad debt but also with losing over 90% of the presumed

value of the bonds. Her wine supplier claims bankruptcy, closing the

doors on a family business that had endured for three generations, and

her beer supplier is taken over by a competitor, who immediately closes

the local plant and lays off 150 workers.

Fortunately though, the bank, the brokerage houses and their respective

executives are saved and bailed out by a multi-billion dollar,

no-strings attached cash infusion from their cronies in Government. The

funds required for this bailout are obtained by new taxes levied on

employed, middle-class, non-drinkers who have never been in Heidi’s

bar.

Now you understand!!!

unknown author