The other day, I had a conversation that began something like this: “Crowdfunding, that’s that new term for how you can get the latest gadget or game or movie by ordering it early, right?”

The other day, I had a conversation that began something like this: “Crowdfunding, that’s that new term for how you can get the latest gadget or game or movie by ordering it early, right?”

To which I replied that yes, that could certainly be one way to look at it, but another, and perhaps more accurate way to look at crowdfunding is that it lets those who really believe in an idea or product to put their money where their mouth is (along with that of a number of other similarly-minded people) to help launch a useful product or service that couldn’t otherwise get funded.

Of course, that’s still a limited explanation, because collective financing models such as crowdfunding or microinvesting can do a lot more than that, by helping to leverage the combined power of small individual investments in order to bring about a much bigger outcome.

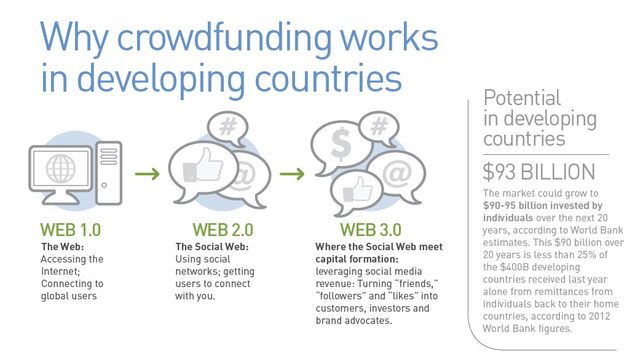

According to an article from Business Funding Solutions, crowdfunding isn’t simply about funding the latest tech gadget or music recording session, it isn’t limited to small amounts of money (overall), and it certainly isn’t going away anytime soon. In fact, a recent report from the World Bank estimates that crowdfunding could represent a $90 billion market as soon as twenty years from now, and it could be a huge factor in the developing world.

“With support from governments and development organizations, crowdfunding could become a useful tool in the developing world as well. Crowdfunding is still largely a developed-world phenomenon but its potential to stimulate innovation and create jobs in the developing world has not gone unnoticed. Substantial reservoirs of entrepreneurial talent, activity, and capital lay dormant in many emerging economies, even as traditional attitudes toward risk, entrepreneurship, and finance stifle potential economic growth and innovation. Developing economies have the potential to drive growth by employing crowdfunding to leapfrog the traditional capital market structures and financial regulatory regimes of the developed world.” – Crowdfund Capital Advisors (CCA)

The report from CCA, titled Crowdfunding’s Potential for the Developing World, stresses that countries with developing economies can leverage the power of crowdfunding to spur growth and innovation, but in order to do so, they need to understand the ‘best practices’, policies, and necessary tech infrastructures that are being used successfully in First World markets for crowdfunding.

“Developing countries that manage this process successfully may be able to leapfrog the developed world, in both a regulatory and economic sense, by creating frameworks for early-stage finance that facilitate entrepreneurship, the fostering of innovative technology enterprises and the emergence of new competitive industries.” – CCA

Covering the current state of crowdfunding, opportunities (and risks) in the developing world for this practice, as well as recommendations for policies and frameworks for evaluating crowdfunded investing, this report could be a great resource for governments, NGOs, and the private sector alike. Get your copy at CCA: Crowdfunding’s Potential for the Developing World

See the full crowdfunding infographic at CCA.