Four more years in the White House and Barack Obama reckons ‘the best is yet to come’.

Does the market support his optimism? Can investors find opportunities to shelter from the storm?

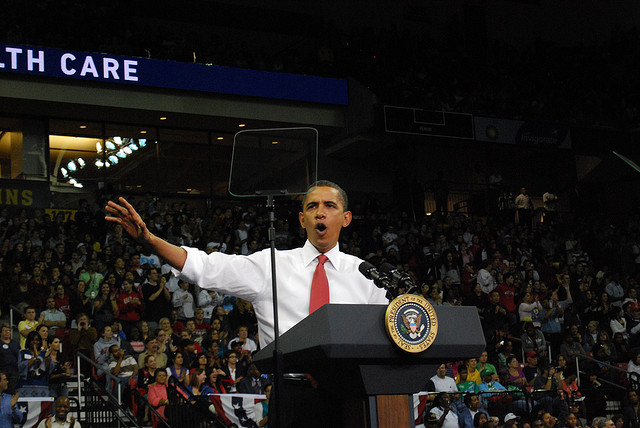

The re-election of the 44th President of the United States has never been more significant to global investment understanding. While in some quarters Barack Obama’s success has been greeted with tangible relief, other forecasters warn of the impending doom facing the US economy.

This article sets out to examine the impact of the presidential race and its effect on investors’ confidence. Are there still options for the savvy investor in a seemingly unstable financial climate?

Once the dust has settled on the fierce voting for control of the White House, many financial institutions will be forced to put aside differences of red and blue and focus pragmatically on the fortunes of the greenback (US dollar). The burning question on every investor’s mind is whether the Obama administration will help or hinder profits.

The constant speculation from analysts was not whether Barack Obama would win, but whether he would gain the power necessary to implement change needed to avoid the ‘fiscal cliff’.

A buffalo analogy may be pertinent. American politics has unfortunately tethered the US financial institutions to a stubborn, slow-moving bovine, wide-eyed and reticent to any opposition to its rightful habitat. It’s known to steadfastly refuse to be drawn into meaningful engagement that diverts it from its path, even if that path leads to a drop that will plunge the economy into a recession.

There are two outcomes for the present administration. The first involves gently coercing a Republican-dominated House of Representatives and a partisan-Democrat Senate into a mutually beneficial slow turn acceptable to both parties. This is perhaps the most palatable outcome and the one the marketplace is anticipating.

Crucial to the stability of the US economy, the status quo has been resumed and politically nothing much has changed. In this way, President Obama, billed as the ‘continuity candidate’, has successfully blocked any major changes in policy that may have come to pass had Mitt Romney and the Republicans been elected, such as the extension of tax cuts for the wealthiest 1%.

If Mitt Romney had won office, his financial engineering might well have stimulated a shot in the arm for business growth in the short term, while economists feared his opposition to quantitative easing. The chairman of the Federal Reserve, Ben Bernanke and any specific change to foreign policy would raise significant question marks over long term financial prospects. Marketplaces do not like question marks, they prefer certainties.

While the Obama administration clearly frustrates wide swathes of American voters, particularly in the south and central plains states, on the eastern and western seaboard and particularly abroad he is undoubtedly popular, in no small part due to his ongoing support of clean energy. This is seen as critical and foreign investors have borne out the hypothesis that ‘it’s better the devil you know’.

The second outcome seems less desirable. This article continues…..