Using the power of microfinance to help people help themselves out of poverty is something usually only discussed in the context of the developing world, where the loan of a relatively small sum of money could make the difference between barely surviving and thriving.

Using the power of microfinance to help people help themselves out of poverty is something usually only discussed in the context of the developing world, where the loan of a relatively small sum of money could make the difference between barely surviving and thriving.

But there are plenty of other places on the planet where the same principle applies, so why isn’t microfinance a bigger deal in the developed world?

Known as the “father of microcredit,” Professor Muhammad Yunus developed the Grameen Bank in Bangladesh over a long period of years, finally getting it to the point of being a fully licensed bank in 1983.

Since then, Grameen has been using microfinance and microcredit to help eradicate poverty through microlending funds to some 7.5 million borrowers in Bangladesh. The bank has now expanded to 38 countries and has made over 100 million microcredit loans, to great success.

That’s the more well-known side of Grameen, but the rather surprising side (to some) is the fact that there has been a branch of Grameen Bank in Jackson Heights, Queens since late 2007, and another two branches have since opened, in Brooklyn and in Manhattan. And as of June of 2011, Grameen America has granted microcredit loans of millions of dollars to its thousands of borrowers, at a payback rate of 99%, and the recipients of these loans have now collectively saved over a million dollars in their personal bank accounts, none of whom had previously had savings accounts at all.

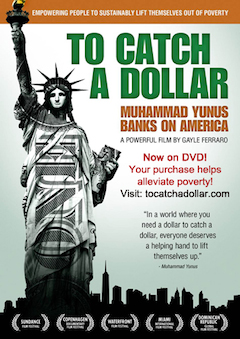

To try to bring awareness of the importance of using microfinance in America to help eradicate poverty, a documentary from filmmaker Gayle Ferraro tells the stories of the challenges and successes of the recipients of microloans in the U.S.:

“The film follows Nobel Peace Prize winner Professor Yunus as he brings his unique and revolutionary microfinance program to the US. Witness the birth of Grameen America and the compelling story of the first women borrowers; from the challenges they face to the successes they achieve, as they learn to sustainably rise from poverty by starting and growing their own businesses with the education, support, and non-collateral microloans they receive.”

To learn more about this inspiring movement, to host a screening of the film, or to donate to help establish the first publicly funded Grameen America branch in the United States, see To Catch a Dollar.